JPM Analysts Flip-Flop iPhone 16 Demand Forecast In Just Three Days

Apple shares are hovering around $227 on Wednesday afternoon, commanding a market capitalization of $3.45 trillion. With shares near all-time highs, the last thing bulls want to hear is how quickly some of Wall Street’s top analysts are downshifting their outlook on iPhone 16 demand. In other words, the hype around the AI-enabled iPhone and its supposed ignition of the most massive upgrade cycle seems to have been nothing more than a giant flop this fall—at least for now.

Let’s begin with the most epic flip-flop in coverage. On Sept. 27, a team of JPM analysts led by Samik Chatterjee and Joseph Cardoso penned a note to clients titled “Lead Times Suggest Slower Initial Demand for Pro Models Starting to Correct.”

In the note, JPM analysts cited their Apple Product Availability Tracker, which showed lead times for iPhone 16 models moderated, with lead times for base models seeing a notable reduction while Pro models remained stable. They concluded that initial weaker demand for the Pro models was likely a temporary issue, with momentum expected to increase as Apple Intelligence’s release approaches.

Here’s the blurb from the note:

In Week 3 of our Apple Product Availability Tracker, delivery lead times are showing trends which, if continued, will explain the weaker lead times for the Pro models in the initial weeks as only an aberration led by a combination of better supply mix as well as delay in pick up in momentum from higher end consumers awaiting the release of Apple Intelligence. Lead times in aggregate have moderated as expected following the peak in Wk2, but Pro model lead times remained steady contrary to a moderation being typical in prior years for Wk3. The moderation in the last week for iPhone 16 series in aggregate was led by Base models, while lead times for Pro models were stable; iPhone 16 (Base model) moderated by 7 days (vs. moderation of 1 day from Wk2 to Wk3 last year for iPhone 15), with moderation of 11 days for the Plus model (vs. moderation of 1 day from Wk2 to Wk3 last year for 15 Plus), but lead times for Pro and Pro Max held steady over the last week relative to moderation of 7 days and 9 days, respectively, from Wk2 to Wk3 for 15 Pro and Pro Max. In aggregate, although overall lead times for the iPhone 16 models are still lower relative to iPhone 15 last year, narrowing of the gap between the two groups (Base vs. Pro) over the last week as well as steady lead times for the Pro models are highlighting the likelihood that the initial slower momentum in demand for the Pro models is correcting itself with the release of Apple Intelligence drawing closer. Please see pages 3 and 4 for charts.

However, several days later, on Oct. 1, JPM analysts confused their clients with an epic flip-flop on the iPhone 16 demand outlook. The note is titled “Near-term Upside Likely Limited with AI Availability the Gating Factor; However, AI-Upgrade Cycle Expectations Remain Intact.”

Whoops!

As mentioned in our recent checks via our lead time tracker (see here), the difference in the lead times relative to prior years in the early weeks points to a more muted momentum in early orders for the Pro models relative to our original expectations, likely due to the unavailability of AI capabilities, with consumers likely delaying purchases until the features are available and the value proposition is better understood. As a result, we are moderating our near-term iPhone unit forecast, such that we now expect aggregate iPhone volumes to track to ~126 mn in calendar 2H24 (vs. ~130 mn prior and ~132 mn a year ago).

We first noted this flip-flop by JPM analysts on X…

JPMorgan now expects aggregate iPhone volumes to track to 126M in the second half of 2024 versus 130M prior and 132M a year ago.

— zerohedge (@zerohedge) October 2, 2024

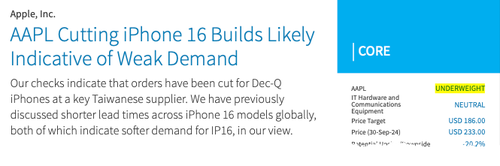

On Tuesday, Barclays analysts led by Tim Long and George Wang told clients after running supply chain checks. They found Apple likely slashed production of the new phone for the December quarter over weaker-than-expected demand.

We have cited a number of reports that show the hyped-up AI iPhone launch cycle has likely disappointed:

- No AI-Fueled Upgrade Supercycle? Apple iPhone 16 Discounts Offered At Major Chinese Online Retailers

- Apple Slips On Pre-Order Analysis Showing Weak iPhone 16 Pro Demand

- Apple’s iPhone 16 Sales Falling Short Of Expectations; DigiTimes Says

- Barclays Analysts Find “Weak” iPhone 16 Demand After Supply Chain Check

Maybe ‘moar’ buybacks, Tim Cook?

Here’s what X users are saying in response to the JPM flip-flop:

Stock adds over $1.6 Trillion in “value” based on declining sales of main product. What a world.

— lemmy lemon (@lemmylemon8) October 2, 2024

Who can afford any luxury items these days?

— Ballot Farmer Comrade Ziiggii (@realZiiggii) October 2, 2024

With the slight drop in projections, curious to see how Apple plans to adapt and keep up its market share.

— Kimz 🙃 (@SpyMk2124) October 2, 2024

Iphone sales are actually much worse. No idea why JP Morgan things it will slightly lower

— Vshan_Crypto (@Vshan_Crypto) October 2, 2024

Wed, 10/02/2024 – 15:45