Behind Today’s Stunning Jobs Report: A Record Surge In Government Workers

At first glance today’s jobs report was indeed impressive: the surge in jobs according to both the household and establishment surveys indicated a strong rebound from recent monthly weakness…

… which coupled with the drop in unemployment rate, and upward historical revisions suggested that much of the recent labor market weakness may have been transitory. The one fly in the ointment was the jump in wage growth which strongly hinted that inflation is also back, just as we have been warning for months (especially now that oil is once again surging) and we will cross that bridge eventually, but not yet.

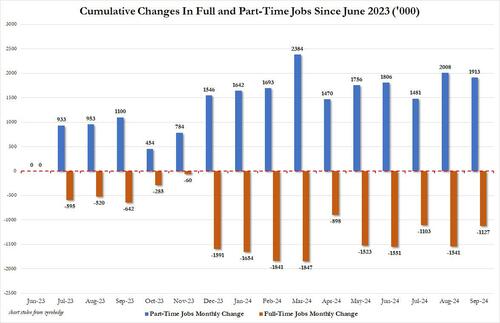

Instead for now let’s focus on the parts of the jobs report which the BLS has traditionally used to mask headline weakness, such as part-time workers used to mask weakness in full-time jobs, or foreign-born workers surging at the expense of native-born. Well, this month there was little of that as well, and in fact, part-time workers dropped modestly as full-time workers rose…

… while native-born workers actually rebounded from a five year low as foreign-born workers dropped from an all-time high

And yet, it didn’t take long to find what the BLS did this time to make the jobs appear much stronger than expected, a political imperative for the highly politicized agency tasked with making the Kamala/Biden economy appear stronger than it was exactly one month ahead of the election.

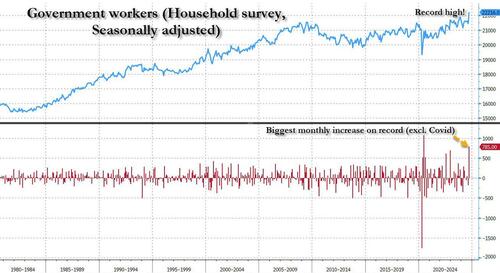

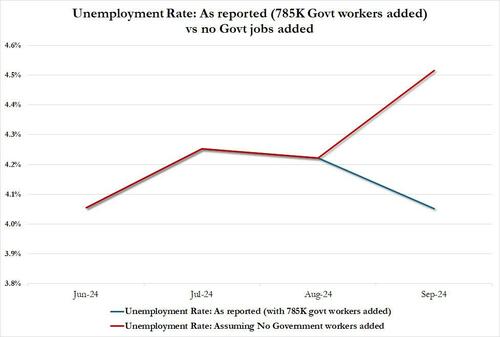

The answer, ironically, was in the number of government workers, which exploded higher, and were not only instrumental in pushing the Household Survey print much higher, but meant the difference between a 4.1% and 4.5% unemployment rate.

Here is what happened.

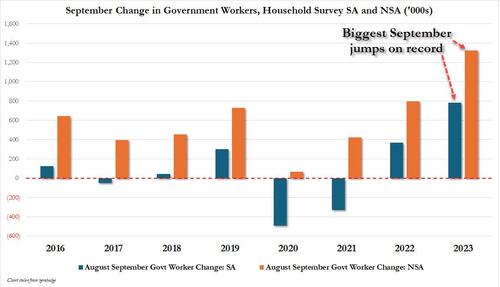

In September, the number of government workers as tracked by the Household Survey soared by 785K, from 21.421 million to 22.216 million, both seasonally adjusted (source: Table A8 from the jobs report). This was the biggest monthly surge in government workers on record (excluding the outlier print in June 2020 which was a reversal of the record plunge from the Covid collapse months before).

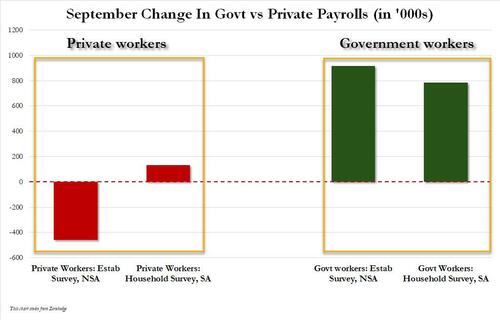

While government workers soared by the most on record, private workers rose by just 133K, a far more believable number, and one which however would indicate that the recent labor market malaise continues.

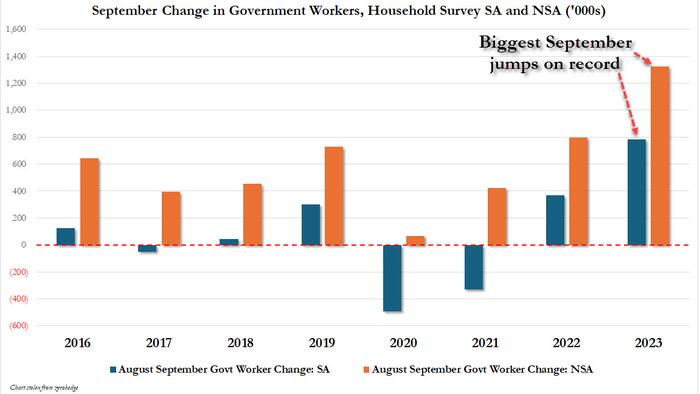

What is odd is that while September traditionally sees a huge jump in not seasonally adjusted government workers (as teachers go back to school), the BLS has traditionally smoothed over this jump using seasonal adjustments.

Only not this time, because as noted earlier by Andrew Zatlin of Southbay Research, while historically the September adjusted number has been relatively tame, regardless of how large or small the unadjusted number was, this time something changed as the unadjusted number of government workers absolutely exploded by a record 1.322 million leading to a record September increase in adjusted government workers.

“It’s remarkable to see a one-month 3% jump in government jobs. Perhaps these are the hall monitors for the polling booths. Or perhaps these numbers are just wishful thinking. One thing is for certain, the Fed gets a hall pass next month when the ugly post-Hurricane numbers come out” said Zatlin.

Curiously, it wasn’t just the Household survey that tracked an unprecedented increase in government workers: if one takes the Establishment survey unadjusted print (source Table B1 from the jobs report), one sees the exact same thing. Here, the number of not seasonally adjusted government workers soared by 918K (from 22.541 million to 23.459 million), while the number of not seasonally adjusted private sector workers plunged by 458K!

Why does any of this matter? For several reasons.

As the recent near-record downward revision in employment demonstrated, when some 818K jobs were magically eliminated, economic reports from the Biden admin has become unreliable to the point where even Fed chair Powell was questioning the credibility of BLS data and lamented that had he known how bad the labor market was, he would have cut in July. Well, same thing now, only in the opposite direction (which is to be expected with the election in just one month). So is the BLS now openly political and seeking to game the data to show Biden in a favorable light? That’s a rhetorical question we leave to our readers.

And speaking of politicized government agencies, the BLS had a clear motive to add as many “government jobs” as it possibly could, not just to make the sequential increase in labor appear but to depress the unemployment rate further.

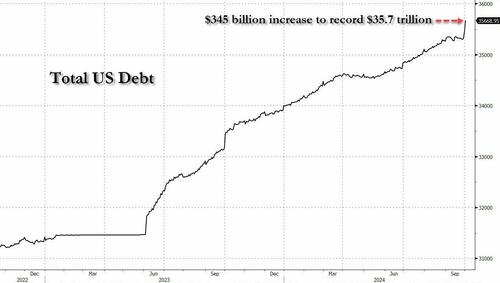

So to answer the question: why jam a record number of government workers in the September payrolls report? Two reasons: Unemployment rate drops to 4.1% instead of rising to 4.5%, assuring the Sahm Rule is indeed triggered and the US is officially in a recession, and also prevent the market from crashing. Both, one would say, pretty critical narrative pieces exactly one month before the election. As an aside, those wondering who is paying for all these government jobs, take one look at the US government debt which just soared to a record high, and that should answer all questions.

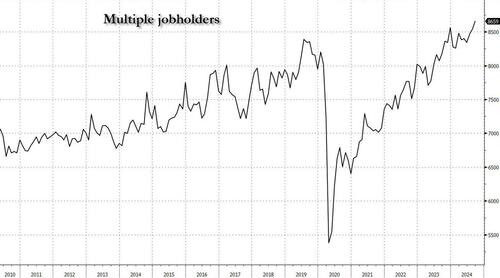

One final point: the BLS may have done everything it could to put lipstick on the jobs market (with data which will inevitably be revised lower after the election), but it forgot to change on data set: the number of people who need more than one job to make ends meet, just hit a new all time high as well.